When the Federal Reserve makes headlines, everyone starts asking the same question: “What does this mean for my mortgage rate?”

Here’s the surprising truth: the Fed doesn’t directly set mortgage rates. So if you’re waiting to hear about a Fed rate cut before you call your loan officer, you may already be too late.

What Really Drives Mortgage Rates

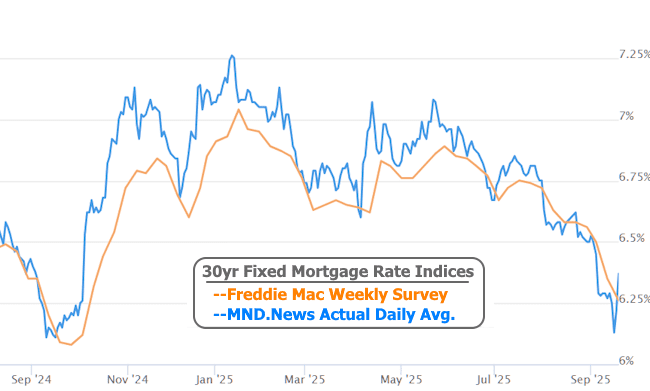

The Fed sets the Fed Funds Rate, which affects short-term borrowing between banks. But mortgage rates, the ones tied to your 30-year fixed home loan, are influenced by the bond market. Investors are buying and selling mortgage-backed securities constantly, and mortgage rates often adjust weeks before the Fed makes an official move.

That’s why mortgage rates c an shift long before a Fed announcement hits the news.

Why You Could Miss the Window

Here’s the catch: the day the Fed lowers rates, it’s usually too late to catch the best mortgage deals. The market reacts in advance, and by the time the Fed makes its statement, lenders have often already adjusted pricing.

This is why so many buyers and homeowners miss opportunities to refinance or lock in a home loan at a lower cost — they’re waiting for a headline instead of staying in touch with their mortgage advisor.

Stay Close to Your Loan Officer

Working with a local mortgage broker is the best way to stay ahead. Your loan officer is watching the market daily, not just during Fed weeks. They can:

- Give you early insight into where rates are trending.

- Help you lock in the right mortgage strategy before markets shift again.

- Guide you through buying, refinancing, or HELOC options with confidence.

Whether you’re a first-time homebuyer, refinancing your current home, or just exploring mortgage options in Arizona, staying connected to your advisor ensures you don’t miss the next opportunity.

The Bottom Line

The Fed makes headlines, but the bond market sets the pace and mortgage rates often move before the Fed does. If you wait until after a Fed announcement to act, the window may already be closed.

👉 Stay close to your loan officer, keep the conversation open, and be ready to move. Because in today’s market, the families who stay prepared are the ones who win.