Every time the news cycle turns toward a possible recession, many potential homebuyers and even seasoned homeowners start asking the same question:

👉 “If a recession hits, will home values crash?”

It’s a valid concern—after all, your home is one of the largest financial investments you’ll ever make. But when we look at the data, the story is often very different than what the headlines suggest.

Home Prices Have Been Resilient Through Most Recessions

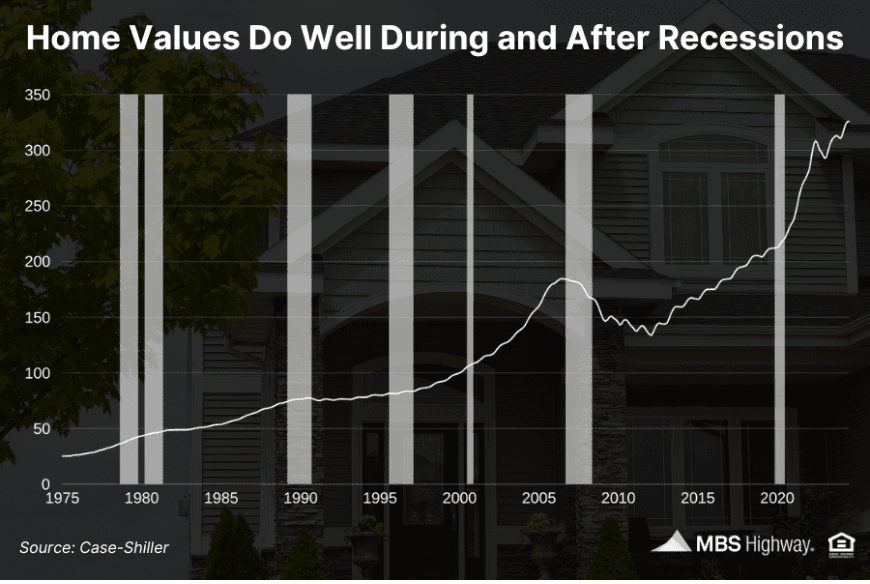

The S&P Case-Shiller U.S. National Home Price Index—a trusted measure of U.S. home prices over time—shows that home values have consistently appreciated over the last 40+ years.

The shaded gray areas in the chart above represent recessionary periods. What stands out is that, with the exception of the 2008 housing crisis, home prices have generally continued to rise through recessions.

This upward bias can be explained by a combination of favorable mortgage rates, limited housing supply, and the tendency for real estate to be viewed as a safe, tangible investment during uncertain times.

Why Home Values Often Hold Steady—or Even Rise—During Recessions

- Falling Interest Rates Stimulate Demand

The Federal Reserve typically lowers rates during recessions to encourage borrowing and spending. You can see this in the Federal Reserve Economic Data (FRED) chart on 30-year mortgage rates, which shows sharp drops during economic slowdowns. - Real Estate as a Safe Haven

When stock markets are volatile, many families prefer putting their money into something tangible—like a home. Historically, homeownership has been a key driver of household wealth according to the National Association of Realtors. - Low Housing Inventory

Unlike other markets, housing supply doesn’t adjust quickly. Builders can’t ramp up new homes overnight, and many sellers choose to stay put during uncertain times. According to Harvard’s Joint Center for Housing Studies, the U.S. has been underbuilding homes for more than a decade, which helps support home values even in recessions. - Demographics Still Drive Demand

Life events don’t stop because of a recession. Families still get married, have children, relocate for jobs, or downsize in retirement. These demographic shifts create a baseline level of demand, regardless of economic headlines.

Lessons From the 2008 Housing Crisis

Many people equate “recession” with “housing crash” because of what happened in 2008. But it’s important to understand that 2008 was the exception—not the rule.

That downturn was triggered by:

- Risky subprime lending practices

- Loose underwriting standards

- Oversupply of new construction

- Speculative investing in real estate

Since then, lending standards have tightened significantly. Today’s borrowers must meet stricter income, credit, and asset verification standards, and the U.S. is facing a housing shortage, not an oversupply.

For more detail, the Federal Housing Finance Agency (FHFA) provides historical home price data that illustrates how unique 2008 really was.

What This Means for You and Your Family

If you’re a homebuyer, a potential recession doesn’t mean you should wait on the sidelines. In fact, it can present opportunities:

- Lower Mortgage Payments: If rates fall during a slowdown, you may be able to lock in a lower monthly payment.

- Equity Growth: Homeownership continues to build wealth over time—even through short-term market fluctuations.

- Less Competition: Some buyers pull back due to fear, which means you could face fewer competing offers on the home you love.

If you’re a homeowner, recessions don’t erase the equity you’ve built. In most cases, values remain stable or climb modestly, protecting your investment.

Bottom Line

A recession doesn’t automatically mean home prices will fall. History shows that housing is one of the most resilient assets, weathering economic storms and continuing to deliver long-term value.

Yes, the 2008 crisis left a scar on public perception. But in reality, that was an outlier caused by unique circumstances. In nearly every other recession, home values have remained stable—or risen.

📌 The takeaway: Don’t let fear of a recession keep you from making the right move for you and your family.

Next Steps

If you’re thinking about buying or selling, let’s talk. I’ll help you cut through the headlines, understand today’s data, and build a plan that works for your unique situation.