Mortgage rates rose after the Fed cut rates in September 2025—confusing, right? Learn why markets behave this way, what’s driving home sales, and how Arizona’s housing market is trending this fall.

Why Mortgage Rates Rose After the Fed Cut Rates

On September 17, 2025, the Federal Reserve cut short-term interest rates by 0.25%. You’d think mortgage rates would follow suit, right? But instead, average 30-year mortgage rates rose from 6.13% to 6.37% in the week after the announcement.

That sounds counterintuitive—but here’s the truth: markets anticipate change. Mortgage rates had already fallen earlier in September (from 6.53% to 6.13%) as bond markets priced in the likelihood of a Fed cut well before the meeting. By the time the Fed officially announced the move, the benefit was already “baked in.”

👉 Key takeaway: Don’t get whiplash from misleading headlines. The Fed doesn’t directly set mortgage rates. Instead, rates respond to expectations about inflation, jobs, and long-term bond yields.

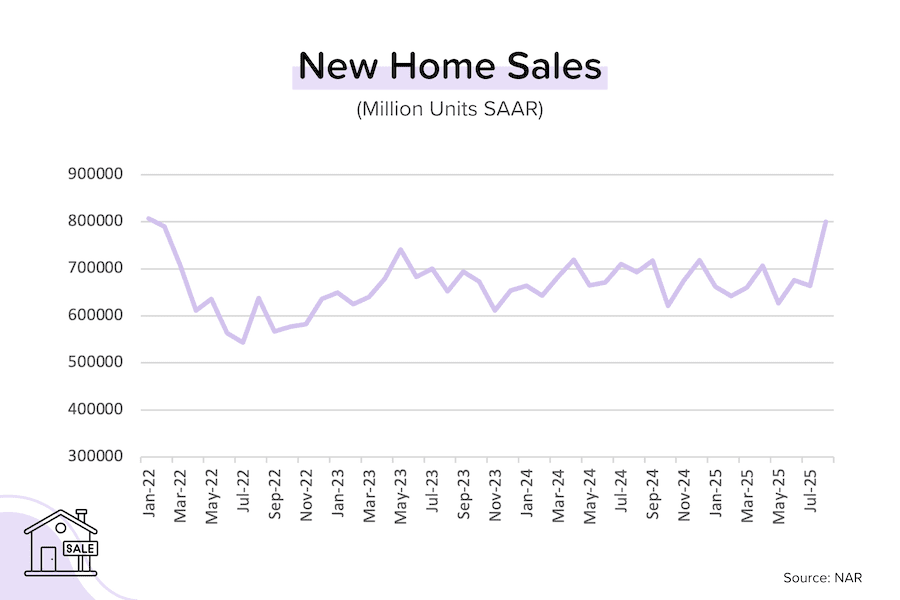

New Home Sales Spiked in August

August 2025 brought a surprise: new home sales jumped to 800,000 units annualized, the strongest pace since January 2022 and a whopping 21% increase from July.

Why the surge?

- Aggressive builder incentives in August (discounts, rate buydowns, and closing cost credits).

- Shifts in buyer demand toward new construction as resale inventory stayed tight.

- Mortgage rates didn’t fall significantly until September, so this was less about affordability and more about builders working to clear completed inventory.

👉 According to Census Bureau data, two-thirds of new home sales came from the South, showing strong regional demand.

Existing Home Sales Still Lagging

While new construction saw a jump, existing home sales slipped 0.2% in August to an annual pace of 4 million units. Prices eased slightly to a median of $423,000.

Why the disconnect? Existing home sales reflect contracts signed in June and July; when mortgage rates were higher. Expect to see stronger numbers when September’s data comes out, reflecting the early-September rate dip.

Is Now the Best Time to Buy a Home?

The old real estate joke goes: “The best time to buy a home was five years ago.” But according to Realtor.com, the week of October 12–18 has historically been the sweet spot for buyers.

Here’s why:

- Inventory is still high from the summer selling season.

- Buyer demand typically cools in the fall.

- That combination means more choices and less competition.

If you’ve been sitting on the sidelines, early to mid-October could be your best shot before the holidays slow things down.

What the Fed Is Signaling

Fed Chairman Jerome Powell summed it up best: “There is no risk-free path ahead.” The Fed is weighing:

- Upside risks to inflation (like tariffs)

- Downside risks to jobs (slower hiring, weaker growth)

Markets now expect:

- Another 25 bps cut on October 29 (86% probability)

- Possibly another on December 10 (65% probability)

Translation: rates may stay volatile through year-end, but the longer-term trend could favor buyers as inflation cools.

Arizona Housing Market Update (as of September 26, 2025)

While national trends get the headlines, local data matters most if you’re buying or selling in Phoenix, Gilbert, Queen Creek, or Chandler.

| Area | Median Price | Active Listings | New Listings (5 days) | Median DOM |

|---|---|---|---|---|

| Gilbert, AZ | $640,000 | 705 | 51 | 58 |

| Queen Creek, AZ | $676,995 | 677 | 39 | 67 |

| Chandler, AZ | $550,000 | 696 | 55 | 53 |

| Phoenix, AZ | $460,000 | 3,889 | 265 | 63 |

📊 Trend: Prices are holding steady across the Valley, with very minor month-over-month changes (mostly flat to -0.2%). Inventory remains elevated compared to earlier this year, giving buyers more negotiating power.

What It Means for Buyers and Sellers

- For buyers: Mortgage rates are lower than this summer, inventory is up, and fall is historically a strong season for negotiating.

- For sellers: While competition has eased, serious buyers are still active especially in affordable price points. Strategic pricing and concessions (like rate buydowns) can help move properties faster.

- For realtors and advisors: Data-driven insights matter now more than ever. Guiding clients with facts—not headlines—builds long-term trust.

The Bottom Line

The headlines may say “Fed cuts rates but mortgages go up,” but that’s only part of the story. Markets move on expectations, not announcements. Meanwhile, the housing market is showing signs of resilience, with new home sales spiking and Arizona inventory offering fresh opportunities.

👉 If you’re considering buying or selling this fall, the best move is to stay close to a trusted mortgage advisor who can help you navigate rate shifts and timing.

📞 Ready to explore your options? Reach out today and let’s map out the smartest strategy for your next move.